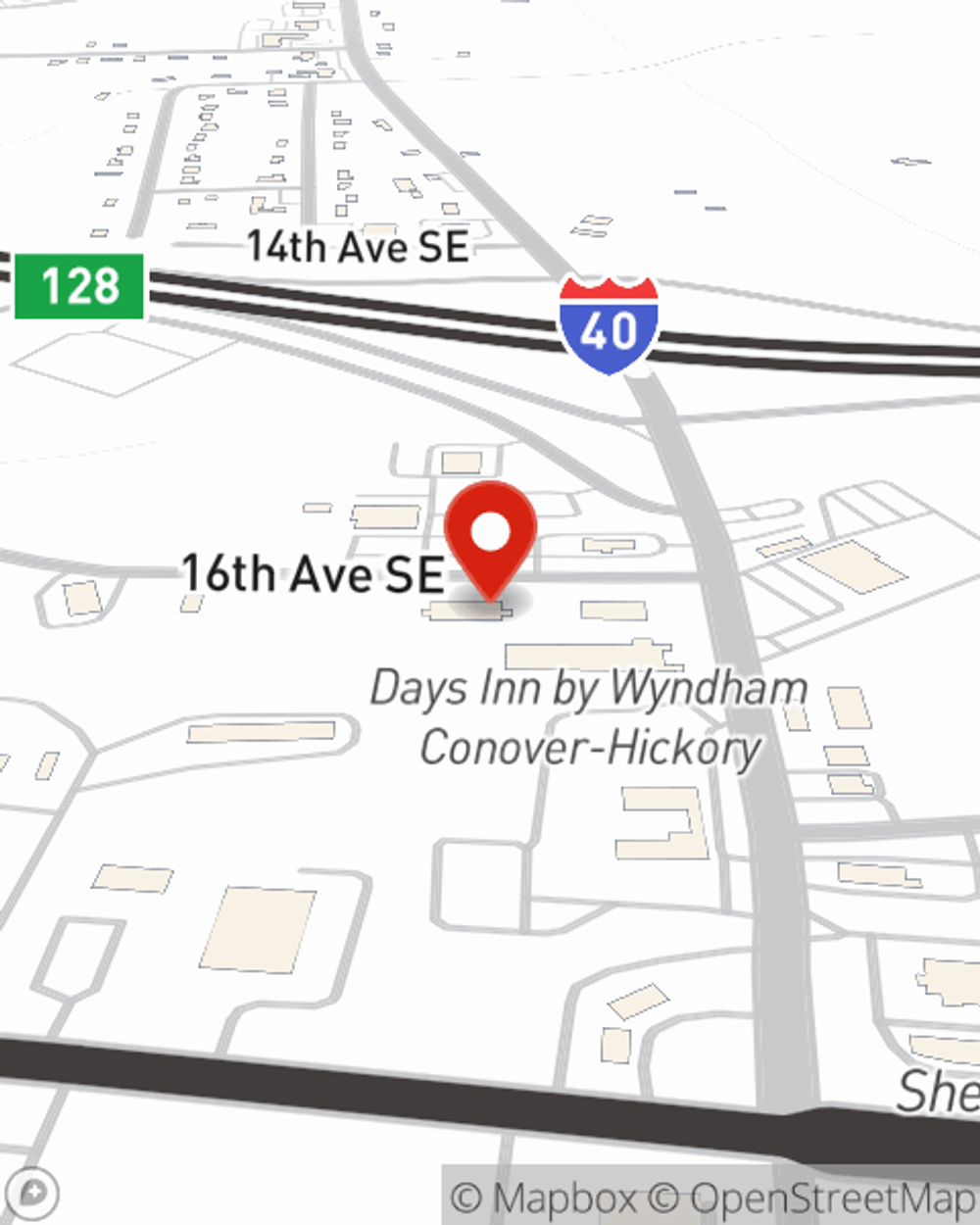

Business Insurance in and around Conover

One of the top small business insurance companies in Conover, and beyond.

Insure your business, intentionally

- Hickory

- Newton

- Claremont

- Catawba

- Sherrills Ford

- Terrell

- Avery County

- Winston-Salem

- Buncombe County

- Taylorsville

- Charlotte

Coverage With State Farm Can Help Your Small Business.

As a small business owner, you understand that sometimes the unpredictable is unavoidable. Unfortunately, sometimes mishaps like an employee getting hurt can happen on your business's property.

One of the top small business insurance companies in Conover, and beyond.

Insure your business, intentionally

Customizable Coverage For Your Business

No one knows what tomorrow will bring—especially in the business world. Since even your brightest plans can't predict consumer demand or natural disasters. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for protection with a State Farm small business policy. Business insurance protects more than just your facility or shop.. It protects your hard work with coverage like worker's compensation for your employees and a surety or fidelity bond. Fantastic coverage like this is why Conover business owners choose State Farm insurance. State Farm agent Sig Holcomb III can help design a policy for the level of coverage you have in mind. If troubles find you, Sig Holcomb III can be there to help you file your claim and help your business life go right again.

Don’t let concerns about your business stress you out! Get in touch with State Farm agent Sig Holcomb III today, and see how you can benefit from State Farm small business insurance.

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Sig Holcomb III

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.